The world is reeling from the effects of COVID-19. The U.S. economy has taken a serious hit—unemployment rates are sky-high, businesses are closing, and the Federal Reserve is stepping in big time. They’ve cut interest rates to almost zero and rolled out huge stimulus packages. Trillions of dollars are being pumped into the economy. But what does that mean for the markets?

Here’s the thing: when you print that much money, it doesn’t just disappear. All that cash has to go somewhere. And in times like these, a lot of it flows into the capital markets, pushing prices up. We’ve already seen the stock market bounce back faster than expected. This is largely because all this extra liquidity is chasing returns.

This is where I expect crypto to shine, too. Historically, in moments of global uncertainty, we’ve seen people flock to alternative assets. Gold used to be the go-to, but now Bitcoin is stepping into that role. With governments around the world printing money like crazy, people are looking for assets that can hold their value.

What is M2 Money Supply, and Why Is It Important?

Now, let’s break down the concept of M2. In simple terms, M2 is a broad measure of the money supply that includes cash, checking deposits, and easily convertible near-money. It’s different from M1, which includes only physical cash and checking accounts. M2 adds savings deposits, money market funds, and other time deposits, making it a more comprehensive look at the money circulating in the economy.

So why should we, as investors, care about M2? Because it’s one of the best indicators of liquidity in the economy. When M2 grows rapidly, like it is now, it shows that more money is available for spending and investment. This influx can inflate the prices of everything—stocks, real estate, and yes, even crypto. More money in the system means more capital is available to flow into assets, potentially driving their prices higher. As a result, monitoring M2 can give us valuable insight into where markets might be headed.

When central banks, like the Federal Reserve, expand the money supply to stimulate growth, the effects can ripple through the capital markets, inflating asset values. That’s why tracking M2 is critical—it helps us understand just how much liquidity is out there and where it might go next.

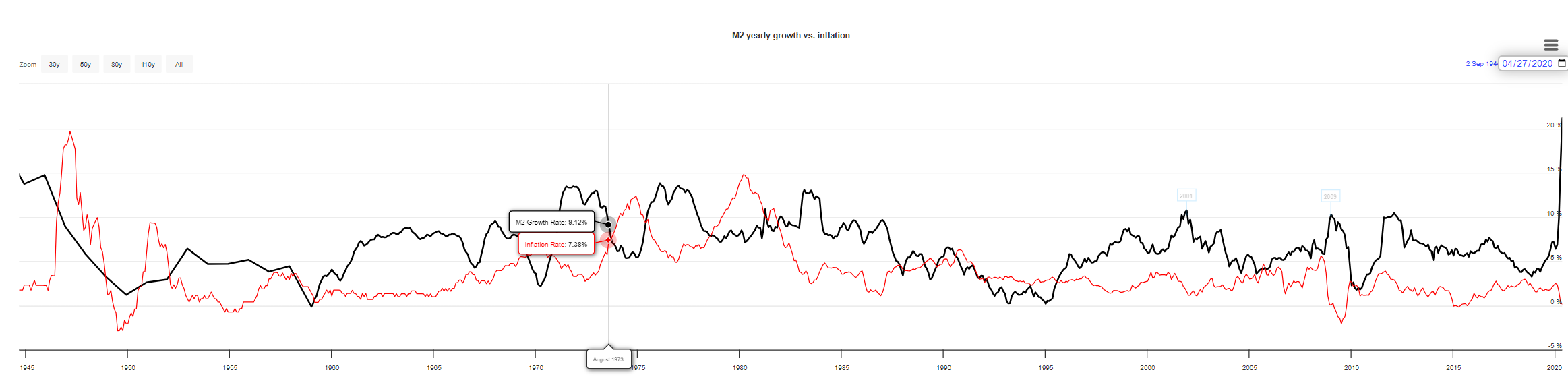

Source: Longtermtrends

You can see from the chart above, the amount of money being injected into the system is unprecedented (the black line is for M2 supply, whereas the red line is for inflation). Inflation tends to follow M2 over longer periods of time. And when the dollar gets devalued like this, assets like Bitcoin, which have limited supply, tend to benefit.

Crypto Analysis: Bitcoin and Ethereum Prices

Let’s get into the crypto side of things. Bitcoin and Ethereum have had a wild ride so far this year. We saw a massive crash in March when the markets freaked out over COVID. Bitcoin tanked from around $10,000 to $4,000 in just a few days, and Ethereum followed suit.

But here’s the kicker: they’re undervalued right now. Prices have taken a hit, but the fundamentals haven’t changed.

- Fear is still driving the market. Right now, a lot of people are scared to jump back in, so prices are staying low. This is where Warren Buffet’s famous quote comes to mind: “Be fearful when others are greedy, and greedy when others are fearful.” We’re in a fearful market—meaning it’s a great time to get in before the crowd comes back.

- Inflation Hedge: As we’ve seen with the government printing money, inflation is going to be a big issue down the road. Bitcoin and Ethereum, with their limited supply, act as a hedge against this.

Take a look at the long-term Bitcoin price chart above. You can see that after every major dip, there’s a strong recovery. This is no different. Combine this with the fact that Bitcoin’s halving is coming up, which will reduce the new supply of Bitcoin being created, and we could be in for a perfect storm. - Undervalued Opportunities: Right now, Bitcoin and Ethereum are both priced much lower than their potential. We’ve seen this pattern before—markets panic, sell-off, and then recover stronger than ever. With so much uncertainty and fear still in the air, now could be the ideal time to invest.

My Trades: Putting $1,000 into Crypto

Alright, here’s where I’m putting my money. I’m going to invest $1,000 into crypto, and I’ll split it evenly between Bitcoin and Ethereum. Here’s how it looks:

| Cryptocurrency | Investment (PKR) | Investment ($) | Price at Purchase ($) | Quantity Purchased |

|---|---|---|---|---|

| Bitcoin | 83,000 | 500 | $7,500 | 0.067 |

| Ethereum | 83,000 | 500 | $183 | 2.732 |

I’m excited to see how this plays out in the coming months. Jesus, take the wheel!